Finance Careers: Breaking the Boring Myth

Is finance very as boring as people think?

The finance industry oftentimes battle an unfair reputation. Many picture finance professionals hunch over spreadsheets, perform repetitive calculations in silent, sterile offices. This widespread perception has lead countless talented individuals to dismiss finance careers without explore what they unfeigned offer. But is finance really boring? The reality might surprise you.

The exciting reality of modern finance

Finance today bear little resemblance to the stereotype of monotonous number crunching. The field has evolved into a dynamic ecosystem where analytical thinking meet creativeproblem-solvingg. Finance professionals don’t precisely track money — they influence how resources flow through the entire global economy.

Modern finance careers offer:

- Fasting pace environments where decisions impact millions

- Intellectual challenges that require constant learning

- Opportunities to work with cutting edge technology

- Global perspectives and international collaboration

- The satisfaction of help people achieve financial security

Diverse career paths that challenge the stereotype

Investment banking: strategy and deal making

Investment bankers operate at the intersection of business strategy and financial expertise. Far from bore, these professionals:

- Structure complex mergers and acquisitions that reshape industries

- Help companies raise capital through IPOs and debt offerings

- Analyze market trends to identify strategic opportunities

- Negotiate deal worth billions of dollars

The work is intellectually demanding and oftentimes involve high stakes situations where quick thinking and creative solutions are essential. Investment bankers regularly interact with c suite executives and industry leaders, make this career path anything but dull.

Financial analysis: the detective work of finance

Financial analysts are corporate detectives who dig through data to uncover insights that drive business decisions. Their work involve:

- Identify patterns and anomalies in financial performance

- Forecast future trends base on market intelligence

- Evaluate investment opportunities and risks

- Translate complex financial information into actionable recommendations

The investigative nature of financial analysis appeals to curious minds who enjoy solve puzzles and find meaning in numbers. Each day bring new challenges and opportunities to make a tangible impact.

Portfolio management: the art and science of investing

Portfolio managers blend analytical rigor with strategic vision to grow investments. This career combine:

- Develop investment strategies across diverse asset classes

- Analyze global economic trends and market movements

- Make decisive allocation decisions under uncertainty

- Build relationships with clients and understand their goals

The constant evolution of markets ensure that portfolio management remain intellectually stimulating. Professionals in this field experience the satisfaction of help clients achieve financial security while navigate the complexities of global markets.

Source: boringfinancial.com

Financial technology (fintech ) where finance meet innovation

The fintech revolution has created totally new career paths that combine financial expertise with technological innovation:

- Develop blockchain applications for financial services

- Create algorithmic trading systems

- Design user-friendly personal finance applications

- Implement AI and machine learning for financial analysis

Fintech professionals work at the cutting edge of both finance and technology, solve complex problems and create solutions that transform how people interact with money. The field attract creative thinkers who enjoy build new systems and challenge conventional approaches.

The human side of finance

Perchance the well-nigh significant misconception about finance is that it lack a human element. In reality, many finance careers center on help people achieve their goals:

Financial planning: guide life decisions

Financial planners build relationships with clients and help them navigate life’s about important decisions:

- Plan for retirement and financial independence

- Create strategies for education funding

- Develop estate plans to protect family legacies

- Manage risk through appropriate insurance coverage

These professionals combine technical knowledge with empathy and communication skills. They oftentimes develop long term relationships with clients, celebrate their successes and help them through challenges.

Corporate finance: building business success

Corporate finance professionals serve as strategic partners to business leaders:

- Structure capital to fund growth and innovation

- Evaluate potential acquisitions and partnerships

- Develop financial strategies that support business objectives

- Communicate financial performance to stakeholders

This role requires collaboration across departments and a deep understanding of how finance support broader business goals. Corporate finance professionals forthwith contribute to company success and frequently see the tangible results of their work in business growth.

The intellectual challenge of finance

For those who enjoy mental challenges, finance offer constant opportunities to learn and grow:

Market analysis: understanding complex systems

Financial markets represent one of the virtually complex systems humans have created. Analyze these markets require:

- Understand how economic factors influence asset prices

- Evaluate the impact of geopolitical events on markets

- Identify behavioral patterns that drive investor decisions

- Recognize market inefficiencies and opportunities

Market analysts ne’er stop learn as they track the evolution of global financial systems. The intellectual challenge of understand these interconnect forces appeal to course curious individuals.

Risk management: navigate uncertainty

Risk managers develop sophisticated approaches to quantify and mitigate uncertainty:

- Build statistical models to assess potential outcomes

- Design stress tests for extreme market scenarios

- Create hedge strategies to protect against adverse events

- Develop risk frameworks that balance opportunity and protection

This field combine mathematical precision with judgment and foresight. Risk managers must anticipate potential problems before they emerge and develop creative solutions to complex challenges.

The global nature of finance

Finance professionals oftentimes work in an international context that provide exposure to different cultures and perspectives:

International finance: connect global markets

International finance specialists facilitate the flow of capital across borders:

- Structure cross border transactions and investments

- Manage currency risk for multinational corporations

- Navigate different regulatory environments

- Analyze country specific economic conditions

These professionals oftentimes travel internationally and work with colleagues and clients from diverse backgrounds. The global nature of their work provide constant exposure to new ideas and perspectives.

Development finance: create positive impact

Development finance focus on use financial tools to address social and environmental challenges:

- Structure microfinance programs for underserved communities

- Develop sustainable investment strategies

- Create financial solutions for renewable energy projects

- Design innovative funding mechanisms for social enterprises

This grows field attract professionals who want to combine financial expertise with positive social impact. The work offer both intellectual stimulation and the satisfaction of contribute to meaningful change.

When finance might really feel boring

Despite the dynamic nature of many finance roles, certain situations can make finance feel tedious:

Mismatch skills and interests

Finance encompass diverse roles require different strengths. Someone who thrive on human interaction might find back office analysis isolating, while a detail orient person might be uncomfortable in client face roles. Find the right match between personal strengths and job requirements is essential for job satisfaction.

Regulatory compliance without context

Compliance work can feel monotonous when disconnect from its purpose. Professionals who understand how regulations protect market integrity and consumer interests oftentimes find more meaning in compliance tasks than those who see only paperwork.

Early career foundations

Entry level positions in finance frequently involve build foundational skills through repetitive tasks. Understand how these skills contribute to career development can help maintain motivation during this phase.

Find your path in finance

If you’re considered a finance career or look to reignite your interest in the field, consider these approaches:

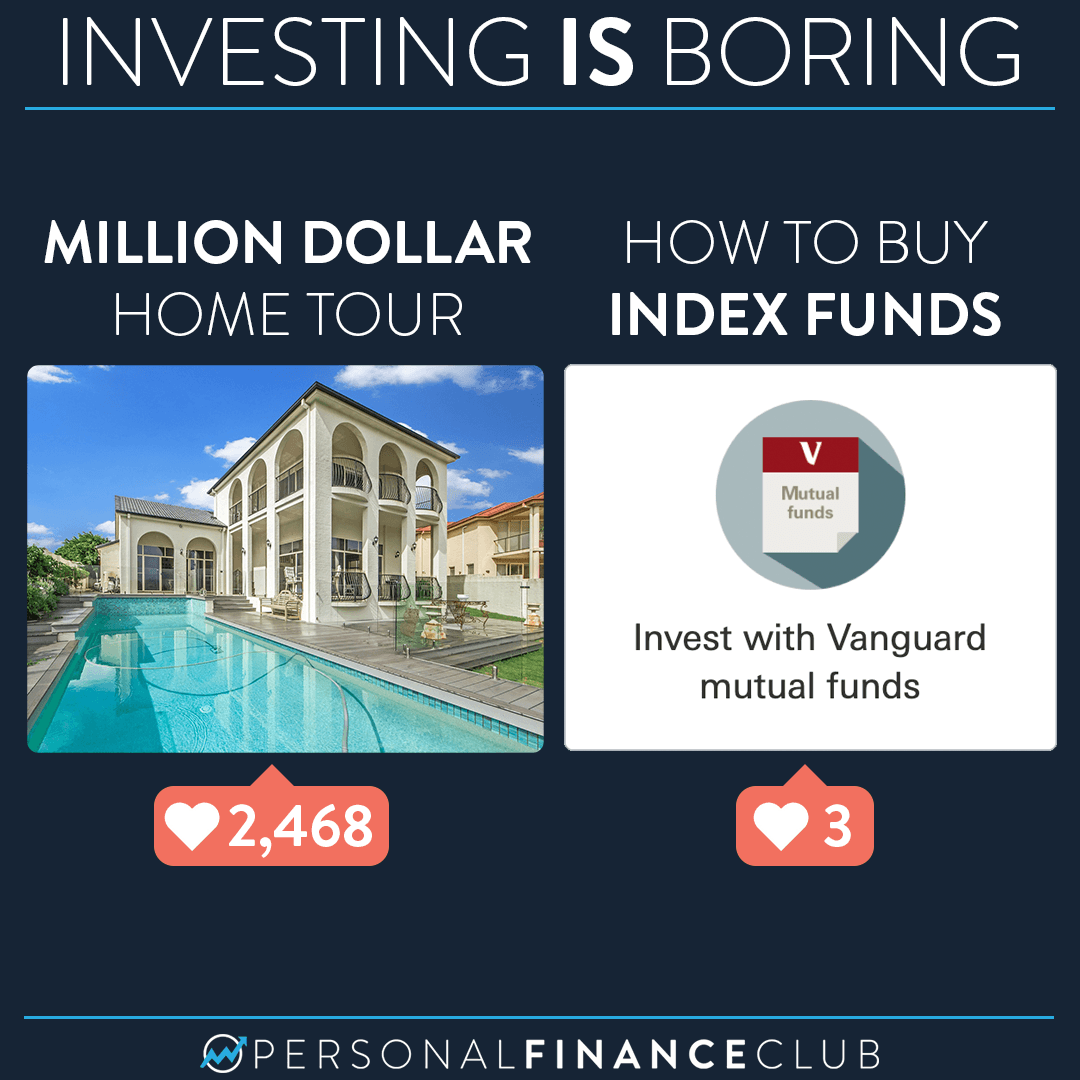

Source: personalfinanceclub.com

Identify your strengths and interests

Finance offer paths for various personalities and skill sets:

- Analytical thinkers might excel in quantitative roles like risk analysis

- Relationship builders frequently thrive in client face positions

- Strategic thinkers can find fulfillment in corporate finance or investment roles

- Creative problem solvers might enjoy financial technology or innovative product development

Understand your natural strengths can help you identify finance specialties where you’re virtually likely to succeed and find satisfaction.

Connect with purpose

Finance professionals who find meaning in their work seldom describe it as boring. Consider how different finance roles contribute to:

- Help individuals achieve financial security

- Support business growth and innovation

- Facilitate economic development

- Create more efficient and accessible financial systems

Find a role align with your personal values can transform finance from a job into a meaningful career.

Embrace continuous learning

Finance is perpetually evolved through:

- Technological innovation

- Regulatory changes

- New financial products and services

- Shift economic conditions

Professionals who embrace this evolution and endlessly develop new skills tend to find the field intellectually stimulate throughout their careers.

The verdict: is finance boring?

Finance, like any field, contain both routine tasks and exciting challenges. What distinguish it from unfeigned monotonous fields is the breadth of opportunities it ofoffersnd its connection ttoomuch every aspect of business and economic life.

For those who appreciate the combination of analytical thinking, strategic decision-making, and real world impact, finance offer infinitely fascinating career paths. The stereotype of finance as boring plainly doesn’t hold up against the reality of modern financial careers.

The virtually successful finance professionals share a common trait: curiosity about how financial systems work and how they can be improved. This curiosity transform potentially routine activities into opportunities for insight and innovation.

Kinda than ask if finance is boring, perchance the better question is whether you’ve found the finance specialty that align with your interests, strengths, and values. In this diverse and evolve field, there be likely a path that offer the intellectual stimulation and sense of purpose you seek.